What are the experts saying about home prices?

What are the experts saying about home prices?

It seems like someone is talking about the possible housing market crash everywhere you turn. Will home prices go up or down? When will it happen? Is now a good time to buy or sell? These are all valid questions - but luckily, we have the experts to help us make sense of it all. So what are the experts saying about home prices?

So let's take a look at this quote from Redfin. It says, "For those bearish folks eagerly awaiting the home price crash, you'll have to keep waiting. As much as demand is pulling back, supply is as well. And that's reducing downward pressure on prices in the short run."

So what does this mean? This means houses are staying on the market longer. We're not seeing an influx of new listings. It is still a seller's market. And what we know is that prices are driven by supply and demand. And this is continuing to put upward pressure on home prices.

I know a lot of us are visual people. So, let's look at this graph for the Chicagoland area, which shows the Median Sales Price Appreciation, the rate of appreciation for the past four years. You'll see that Chicagoland is still experiencing appreciation, but the rate of appreciation is slowing down.

Like markets across the nation, the Chicagoland real estate market is experiencing a historically low inventory of homes for sale. We haven't seen inventory levels this low since 2013.

News Listings represent supply, and the Contracts Written represent demand. As in the previously discussed quote, supply and demand are pulling back, reducing the downward pressure on sales prices.

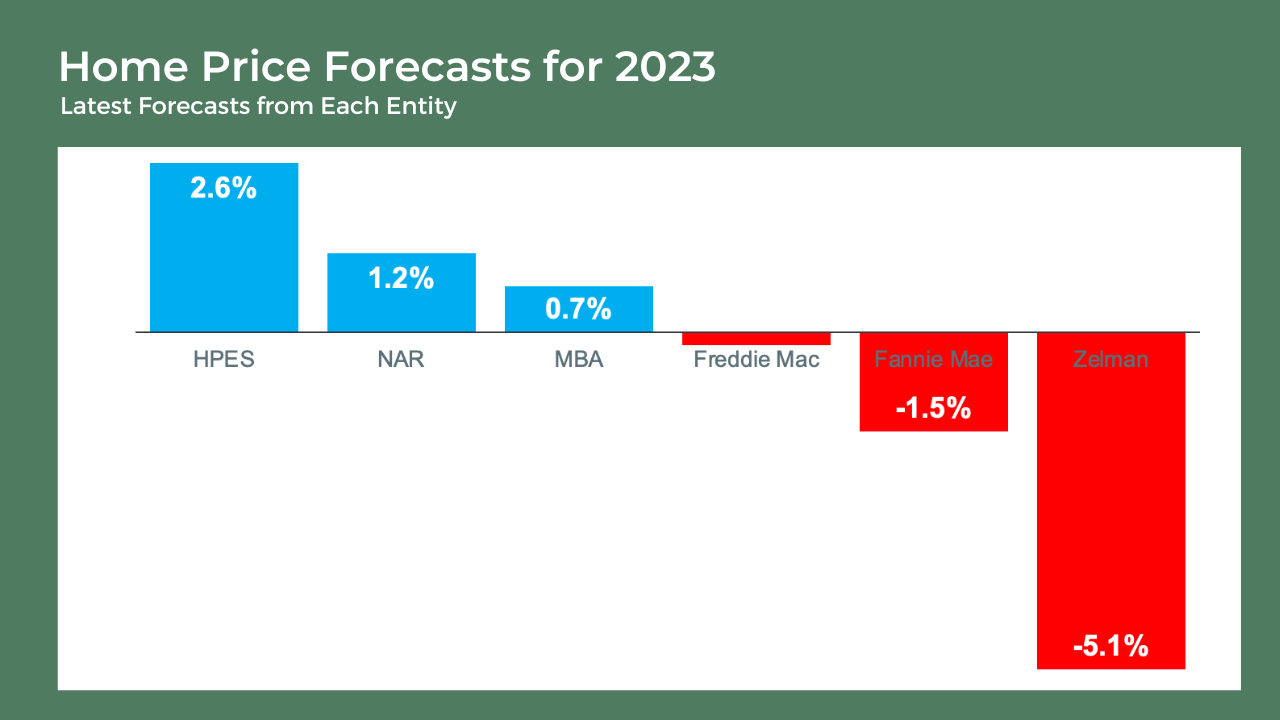

Let's discuss what experts say about the following year's home price forecast. So we like to look across the board at several different experts and average them all out so you can see the whole picture here. You can see here that some experts are projecting a little bit of appreciation next year. That's what you see in those blue bars, anywhere from 0.7% to 2.6% appreciation. We have other experts that are projecting slight depreciation. So it's across the board; a little bit up, a little bit down, depending on how experts view it.

When we average these across the year, there is roughly neutral, flat home price appreciation for 2023. But it's certainly something we'll keep our eyes on as we go forward.

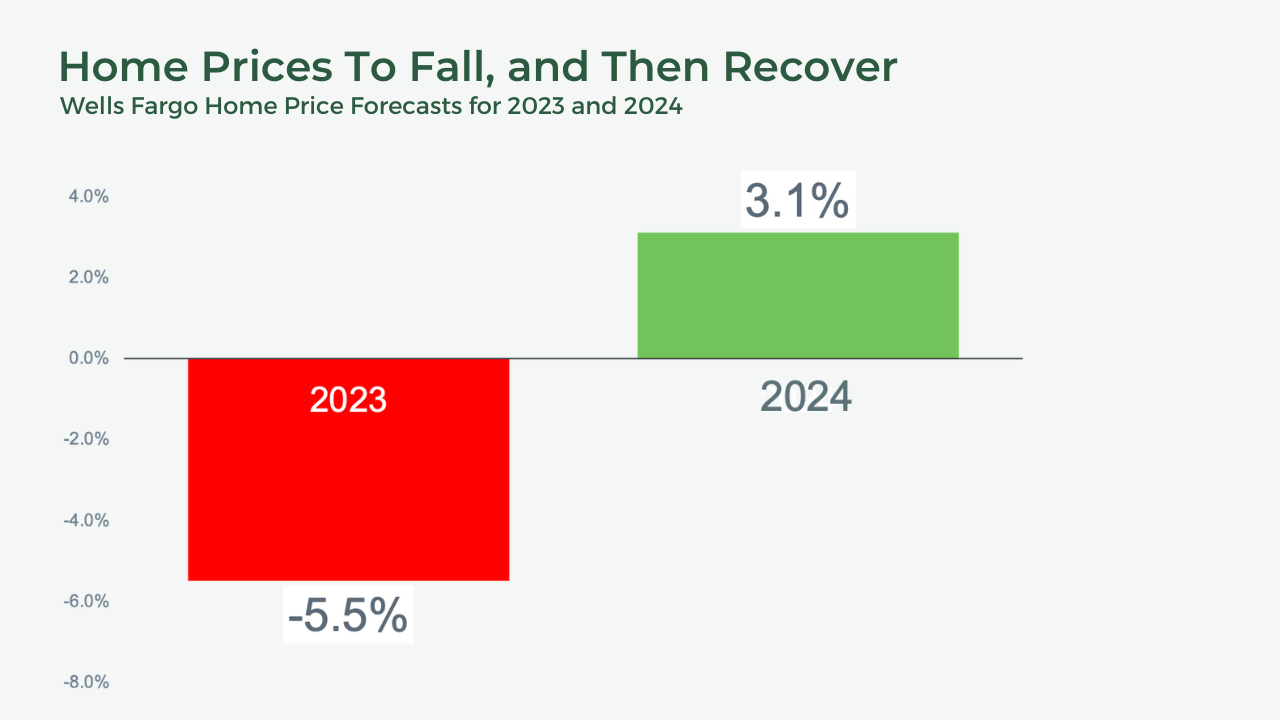

Now, I would like to share another perspective on this with you. Because big banks are projecting more depreciation in 2023, Goldman Sachs, Wells Fargo, Moody's, and Morgan Stanley, you can see that they're shifting more towards, You know what? We may see some slight depreciation next year. And it's a little bit different because some big banks follow more publicly traded builders versus some organizations that follow more existing homes.

And so big banks are calling for more depreciation based on that new build type of environment, versus existing home organizations saying slight appreciation. But what's most important and where they all tend to agree, and this is data from Wells Fargo that positions this well, is that 2023 may be a little bit of depreciation. So it could be rocky next year.

But as we come into 2024 and beyond, we're turning to more normal home price appreciation levels. And as we continue to look forward, as we look at things like the Home Price Expectations Survey saying more normal appreciation in the years ahead, it all depends on supply and demand. And inventory is still historically low. So we will continue to see that in the years ahead.

But 2023, a little bit of depreciation, a little more neutral. So that's the bottom line that we see here. And this quote from Freddie Mac says that well. It says, "While there may be a little statistical difference between a small positive number and a small negative number – talking about some appreciation, some depreciation – there are often huge differences in how they impact behavior."

What we also know, especially as we look back on time, is that we had a great financial crisis. There were five years of continued depreciation. No one is calling for that long extended period of depreciation right now. So it will be a little rocky next year, potentially returning to more normal levels of appreciation. So we're talking about something other than this prolonged financial crisis ahead of us. We're talking about some up and some down next year and then back to more normal levels as we look nationally at that perspective, moving into a much more stable environment.

So, what does this mean? Although 2023 will be a bumpy year, the experts predict the market will be more normalized in 2024. So, if you're a homeowner in Chicagoland wanting to sell and get ahead of the competition, now is the time to start reaching out to us. We have helped homeowners sell their homes when another agent couldn't, and we've also saved our client's thousands of dollars by working with us on getting their homes ready for the market. We know what it takes to succeed in the Chicagoland real estate market, and we can help you too!

Suppose you're a buyer, especially those who put their homebuying dreams on the shelves because of the highly competitive market and plan to stay in the home for several years. In that case, this may be the time for you to revisit buying again. If you haven't already, we encourage you to watch the video on mortgage rates and what happened to rates during the last six recessions. Also, there are 5-year arm products, negotiate with the sellers to contribute money towards a rate buydown, and more. Then, when rates decline, you're not married to them so that you can refinance.

As always, if you have any questions regarding real estate or are ready to start working with us, please reach out to us on our website.

Categories

Recent Posts

"Have any questions regarding real estate or like an introduction to a loan officer I trust?

181 South Bloomingdale Road Suite 101, Bloomingdale, IL, 60108, United States