Will Mortgage Rates keep rising?

Will Mortgage Rates keep rising?

Now, a lot of people are asking the question of whether or not the rates are going to continue to go up. And honestly, no one really knows for sure. But we can take a look at some data and make an educated guess. So stay tuned, and I'll share with you what some of the experts are saying.

Hi, my name is Deborah Benn, one of the partners with Real Estate HubSpot.com, and in this video, I'm going to talk about mortgage rates.

So let’s start with a graph. This is the Freddie Mac 30-year fixed rate from January of 2022, so the very beginning of the year, through where we are today. And, of course, this is a look back. So this is released at the time of this recording, right at the beginning of November. And what we can see from this graph is how rates have climbed drastically this year. The incline is steep at 7% over the past couple of weeks which is a contributing factor to we see a cool down in sales which is causing people to pause their plans and say, “Hey, I'm not sure this is the best time to buy right now."

We’re seeing people who have been priced out of the housing market in the Chicagoland area. Mortgage rates have actually – if you look at this graph- more than doubled this year.

And the pain that people are feeling is because they’re rising so fast. It’s not necessarily just about that 7% number that we’re starting to see them tick around. It’s about the rapid rise.

And I think this quote from Freddie Mac really says it well. It says, “U.S. 30-year fixed mortgage rates have increased 3.83 percentage points since the end of last year. That’s the biggest year-to-date increase in over 50 years.”

So that’s certainly making people press pause. It’s making them question their plans.

You may be curious how this is impacting the Chicagoland market. In this graph, you’ll see that the number of contracts written to purchase a property this year is around the 2019 level. Now, many buyers in 2021 & the first six months of 2022 wished the market slowed down to be less competitive. If this was you, and you put your home-buying dreams aside, pay attention closely, as this could be your market.

Back to mortgage rates. The mortgage rate increase is all about inflation.

So take a look at this quote from George Ratiu from realtor.com. It says, “With inflation still running at a 40-year high and the Fed expecting a few more rate increases to combat it, mortgage rates will experience upward pressure through the end of 2022.”

So why is that? Because the Federal Reserve is making moves to raise the federal funds rate. They’re trying to lower inflation. They’re trying to slow down the economy. And in doing so, they don’t call mortgage rates, but mortgage rates tend to respond. And that’s exactly what’s happening. It’s what we’ve been saying for the bulk of the year now is that while inflation is high, mortgage rates are going to remain high. So we’re seeing that expected upward pressure through the end of the year.

Now, there is good news, and I think Mark Fleming from First American says it well, “While mortgage rates are expected to continue to drift higher over the coming months, much of the rapid increase in rates is likely behind us.”

So we’re not talking about mortgage rates doubling again. Mortgage rates are feeling that pressure. The Fed is making active moves to lower inflation. Mortgage rates respond. We’re still seeing high mortgage rates. But we’re not expected to see this exponential increase as we continue to go forward.

So as we start to see the Fed making moves to lower inflation, to really get this under control, and to see what’s happening in the economy around us, the question starts to come into play, what about a recession? You know that the next thing on the radar is, what happens? Is there a recession around the corner?

And this data from the Wall Street Journal is beneficial. And it is a survey where The Wall Street Journal asked economists about the chances of a recession happening in the next 12 months.

And you can see, in January of 2022, about 18% of economists said, you know what, I think we’re going to see a recession over the next 12 months. Well, as inflation has stayed high, we’ve seen economic pressures in the world around us. We’ve seen the housing market change. You know, that percentage of economists who are expecting a recession over the next 12 months has continued to increase. And the latest data released in October shows that 63% of economists feel that there’s going to be a recession sometime over the next 12 months. And this is reflective of where we’ve seen the economy go over the past year.

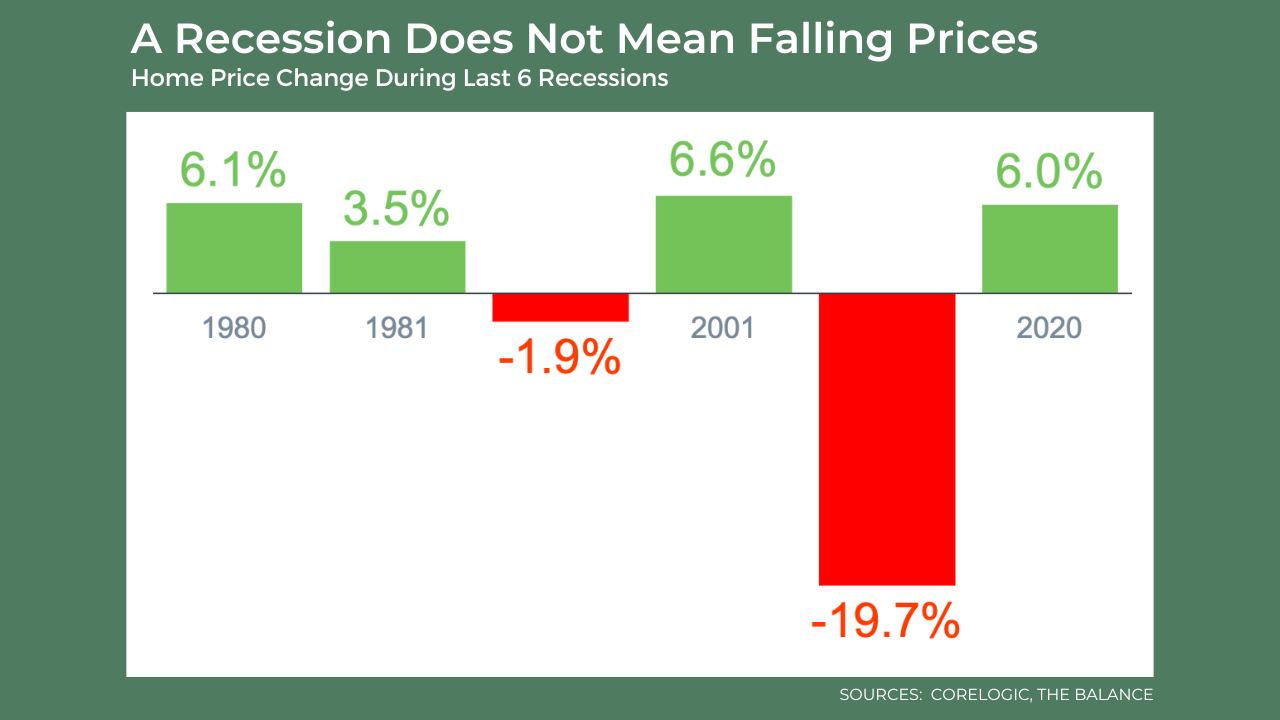

And it starts to spark the question, what does that mean for the housing market? And so, as we look at the housing market, there’s a lot we can learn from history. But let’s see what history tells us when the country experienced a recession, and did it mean falling prices?

Here is data from CoreLogic. Home prices increased in four out of the last six recessions in this country.

Now, we all remember the housing crash in 2008, and I think that’s fresh in our minds and people are fearful of that. But what we have to remember is we have a very different landscape right now when it comes to inventory, when it comes to lending standards and equity. All of these factors are driving the housing market in a different direction.

This graph does not mean that we won’t have falling prices. But it does mean that it doesn’t happen every time. So when we think about what happens in the housing market if a recession is in play, we have to put this context together.

And one thing we can also learn about what history tells us is that a recession more likely means falling mortgage rates. Because in those same six recessions, mortgage rates have dropped each time this country has seen a recession.

I hope these visuals help you understand what does history tell us? I know there is a lot of fear and a lot of uncertainty when experts start saying recession in the housing market.

You know, we’ll have to see how this plays out. We’re going to have to continue to watch and see what happens with inflation and what happens with mortgage rates.

You know, at RealEstateHubSpot.com, we’re the certain path during uncertain times. During the next Real Estate Hub Spot’s Thursday Talk, I will talk more about home prices, so keep an eye out for that.

Several of our clients have utilized a competitive 5-year arm product and had the seller do a buy-down. There are options if you really want to get into a new house. As always, if you have any questions or want to strategize your real estate goals, we’re here to help. We encourage you to connect with us on our website, Real Estate Hub Spot.com.

Categories

Recent Posts

"Have any questions regarding real estate or like an introduction to a loan officer I trust?

181 South Bloomingdale Road Suite 101, Bloomingdale, IL, 60108, United States